AUD/USD advances to session highs above 0.7250 ahead of mid-tier US data

The AUD/USD pair lost 50 pips on Thursday as the risk-averse market environment made it difficult for the AUD to stay resilient against the greenback. With the market mood improving modestly on Friday, the pair staged a rebound and was last seen gaining 0.4% on the day at 0.7260.

Following the risk-rally witnessed earlier in the week, the surging number of coronavirus cases globally caused investors to take a cautious stance. Wall Street's main indexes closed deep in the negative territory on Thursday and the 10-year US Treasury bond yield lost more than 10%.

On Friday, major European equity indexes cling to modest daily gains and the S & P 500 futures are up nearly 1%, suggesting that risk flows are likely to remain in control of markets in the second half of the day.

Meanwhile, the US Dollar Index is edging lower after closing in the red below 93.00 on Thursday. Ahead of October Producer Price Index (PPI) and the University of Michigan's Consumer Sentiment Index data from the US, the DXY is down 0.17% on the day at 92.80.

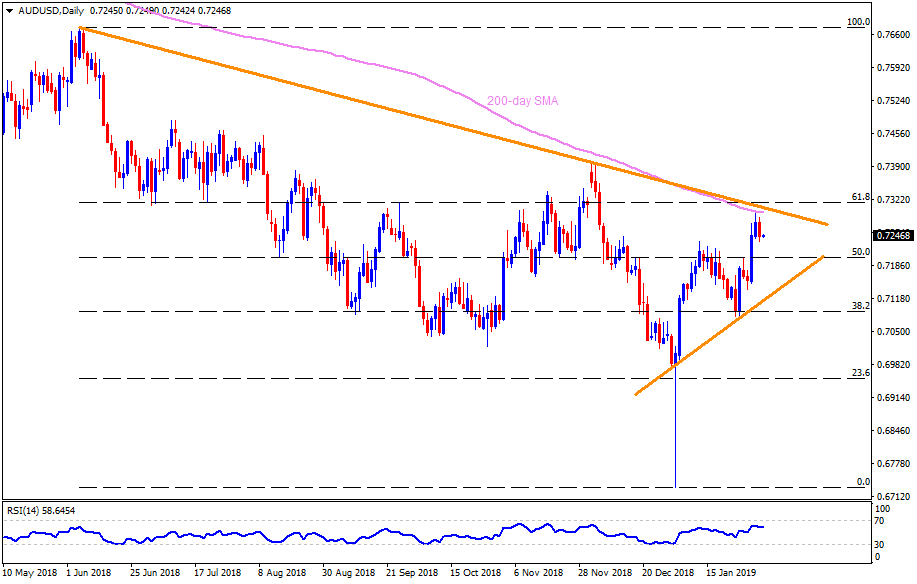

AUD/USD outlook

UOB Group analysts think that AUD/USD is likely to trade in the 0.7130-0.7305 range in the next couple of weeks. "While 0.7200 is still intact, upward momentum has waned considerably and the chance for AUD to move towards 0.7413 has dissipated," analysts noted. "From here, AUD is deemed to have moved into a consolidation phase and is likely to trade between 0.7130 and 0.7305 for a period of time.”

-Published on Nov 13th, 2020

Source : fxstreet